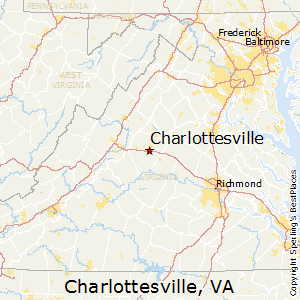

Some financiers observe that there is no such thing as your dream home. To them, every piece of the property needs to be seen with a perspective to earn money. Whether you believe them or not, it is always satisfying to live easily in your own home, which you know you strove for. Whether you are looking for your personal sanctuary or a money-maker, protecting financial investment property funding for a domestic property is a great move to make in many ways. See https://findahomeincharlottesvilleva.com/ Cost of Living in Charlottesville VA .

For one, house financial investments are entitled to tax breaks. Interest is eliminated from your home loan, in addition to local real estate tax from your income tax return. Property taxes can be subtracted incomplete from your federal return. In the long term, these summarize to a huge quantity in savings.

House need smaller sized deposits, and with each regular monthly payment, your ownership of your home boosts. With the aid of financial investment property funding, your small quantities ensure maximum returns whereas other financial investments need you to put whatever in one basket at one time.

You can call the property your own. Some people choose to lease, and some people would rather invest. Both options have their own advantages, and disadvantages, however, would not you rather make month-to-month payments knowing that the property will be totally yours at some point than lease, paying quantities even greater than a home mortgage? With your own home, you are also more inspired to do maintenance as it is your financial investment. In any case, you can have your property for lease to individuals or offices if you will not reside in it. This supplies you with steady month-to-month earnings.

Now, there are plenty of rewards being provided to novice owners, which observers believe will not last much longer. Such rewards are also frequently hung for qualified VA loans. No much better time to jump at this sort of deal than now to increase your financial investment property funding.

With houses, you are enabled to obtain against your equity and deduct interest payments on the overall loan quantity. It is like you are admitted to debt-reduction rewards known provided just to people who have a hard time to pay.

Once your home is completely owned, its worth can value with time, and when you sell it, you are to see huge quantities of real estate earnings. Even better, some or all of your incomes may even be excused from federal taxes. This depends on many aspects; however, most of the time, revenues saw with time is more actualized as compared to a capital gains circumstance.

There are a number of house investment firm in the market who will havea property that may match your requirements, however, keep in mind that they are a revenue-based company so their prices will show their need to generate income on their offers.

In some markets, houses can see sweeping enhancements in the future. With the low rates available today, gratitude is stated to be simply around the bend. People who put their money in the ideal locations at such an essential time as this are bound to get richer.